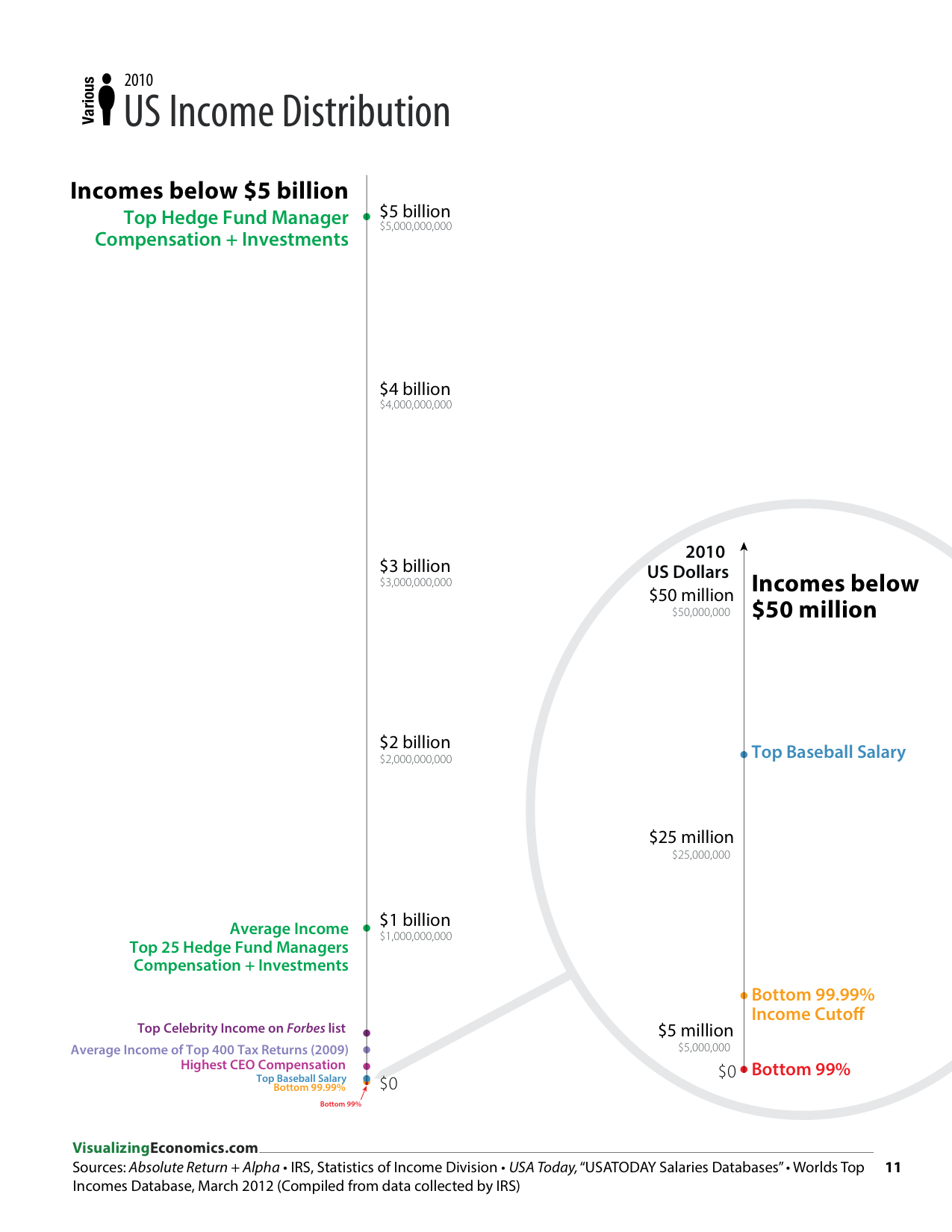

It is official. I am astonished by the size of some of the incomes reported for hedge fund managers. When I first heard about the $150 to $200 million dollar incomes for CEOs and Celebrities (reported by Forbes magazine) that was impressive. But apparently that is barely enough to make the top 25 incomes for hedge fund managers in 2005:

This time there are two who break the billion-dollar barrier: James Simons of Renaissance Technologies Corp. and BP Capital Management’s T. Boone Pickens. In 2005 math whiz Simons, we calculate, earned a staggering $1.5 billion, edging out oil tycoon Pickens, who took home an equally astounding $1.4 billion from two hedge funds he quietly launched ten years ago. . .

. . .One thing that never seems to change for this exclusive club: The cost of admission keeps going up. A manager had to earn at least $130 million in 2005 to qualify for a place among the top 25 money earners, compared with $100 million in last year’s survey and just $30 million in 2001 and 2002. The 26 managers on the list made, on average, $363 million in 2005, a 45 percent jump from the $251 million the top 25 earned in 2004. The average, of course, got a boost from the billion-dollar boys, Simons and Pickens. But the median earnings also grew, jumping by a third, from $153 million in 2004 to $205 million last year.